Dubai, UAE – April 24, 2025: The gold market in Dubai continues to be a focal point for investors, traders, and jewelry buyers alike. Known globally for its tax-free gold and premium quality, Dubai’s gold prices are closely watched by consumers across the Middle East and beyond. As of today, Thursday, April 24th, 2025, the gold rate in Dubai has seen slight fluctuations, reflecting ongoing trends in the international precious metals market.

Latest Gold Prices in Dubai (AED) – April 24, 2025

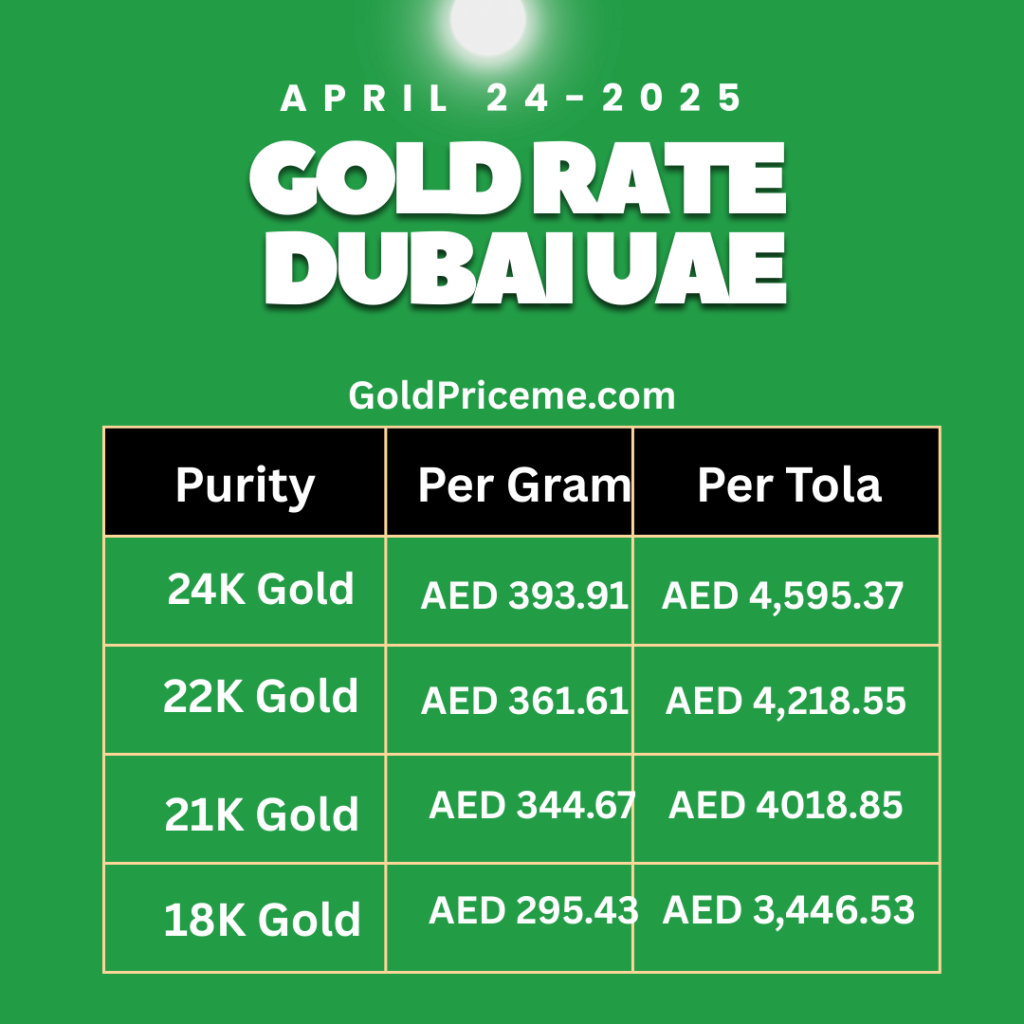

Today’s gold prices in Dubai are as follows:

| Purity | Price per Gram (AED) | Price per Tola (AED) |

|---|---|---|

| 24K Gold | AED 393.91 | AED 4,595.37 |

| 22K Gold | AED 361.61 | AED 4,218.55 |

| 21K Gold | AED 344.67 | AED 4,018.85 |

| 18K Gold | AED 295.43 | AED 3,446.53 |

These rates are updated regularly based on global market trends, currency exchange fluctuations, and supply-demand dynamics in the region.

Why Dubai’s Gold Market Matters

Dubai is one of the most prominent gold trading hubs in the world. With its reputation for purity, competitive pricing, and a wide selection of gold products, the Emirate attracts both tourists and investors looking to buy gold bars, coins, and jewelry.

Also See: Gold Price in Saudi Arabia KSA

The 24 Karat gold, known for its 99.9% purity, is the most sought-after among serious investors and those looking for high-purity gold. Meanwhile, 22K and 21K gold are typically used in jewelry-making due to their durability and shine. 18K gold, which contains 75% gold, is also popular for more intricate designs and western-style ornaments.

Market Trends and Insights

Gold prices in Dubai today are slightly up from earlier in the week, reflecting a modest rise in global spot gold rates. Analysts attribute the increase to renewed geopolitical tensions and inflationary concerns, which traditionally drive investors toward safe-haven assets like gold.

Moreover, with the approaching wedding season in the Middle East and South Asia, retail demand for gold jewelry is expected to rise, potentially influencing short-term pricing trends.

Buying Gold in Dubai – What You Should Know

For anyone planning to purchase gold in Dubai, here are a few tips:

- Check daily rates before making a purchase, as prices can change multiple times in a day.

- Ensure you’re buying from a DGCX (Dubai Gold and Commodities Exchange)-licensed dealer.

- Request a certificate of authenticity for your purchase, especially for bars and coins.

- When buying jewelry, remember that making charges are added on top of the metal price and can vary significantly.

What Influences Gold Prices in Dubai?

Several factors play a role in determining daily gold rates in Dubai, including:

- International gold prices (per ounce), typically dictated by global demand and supply.

- US dollar strength and foreign exchange rates, particularly the AED/USD peg.

- Interest rates, as gold is inversely related to interest-bearing assets.

- Market speculation and geopolitical events, which drive investment flows.

Outlook for the Coming Weeks

With the UAE economy remaining stable and tourism gradually increasing, Dubai’s gold market is likely to stay vibrant in the coming months. If inflation fears persist and global uncertainties rise, further upward movement in gold prices could be seen.

Also Check: Gold Price in Bahrain Today

Investors and buyers are advised to keep an eye on daily fluctuations and consult reputable dealers or financial advisors before making large investments in gold.